Background of trade China and Australia

The exchange between goods and services in two different countries is International Trade. Over time, economists have developed several theories to try and describe global trade. These include the classical theories that are mostly based on countries and modern theories that are based on individual firms. No single theory leads international trade in any part of the world. Regimes use a combination of several of these to develop their International Trade Strategy (Krist, 2013). Theories continue to evolve and change, especially with recent trends in globalization and information technology.

International trade follows several rules, procedures and legislative framework for trading countries whether exporting or importing hence making the Modus operandi complex. There exist several international laws that guide trade.

This paper reviews trade theories, policies and frameworks and trade in between them. The principles, policies and frameworks that shape international trade.

About Australia

Trade is 45% of Australia’s GDP. Trade is responsible for one in 5 jobs in the country. Foreign investments generate about 40% of exports from Australia (Department of Foreign Affairs and Trade, 2020). The country has a population of 25,649, 985 (National State and Territory Population, 2020). Australia has experienced steady economic growth between 1980 to 2020 with no record of recession (IMF, 2020). It is the second wealthiest Nation in terms of Median wealth per adult after Switzerland. And is fourth-largest exporter of wine. The country is 12th on the Global Competitiveness Index. It is the number one global exporter of iron ore and coal, second in aluminium ore and 3rd largest exporter of copper ores (Department of Foreign Affairs and Trade, 2020).

Australia has the 13th Highest GDP (IMF, 2017). 12th ranking internationally for offering a positive business environment. A comprehensive investment strategy guides investment and advocates for free trade agreements, transpacific partnerships, regional value chains and free trade agreements including that negotiated with the European Union.

Australia is a commonwealth country with a similar history as that of the United States of America. They both started as places with indigenous populations before the British sent prisoners. When the USA stopped receiving prisoners and became independent, there was a need for an alternative. The prisoners had to be shipped to Australia. While their history is similar, the economic situations have remained different shaped by different factors.

Thirty-five per cent of Australia is not inhabited. Most cities are along the beaches leaving vast uninhabited land. However, this land is rich in minerals. Natural wealth has shaped the country’s international trade and dictated the International trade partnership resulting in a stable economy which is different from the USA and other commonwealth countries that have experienced a continuous recession.

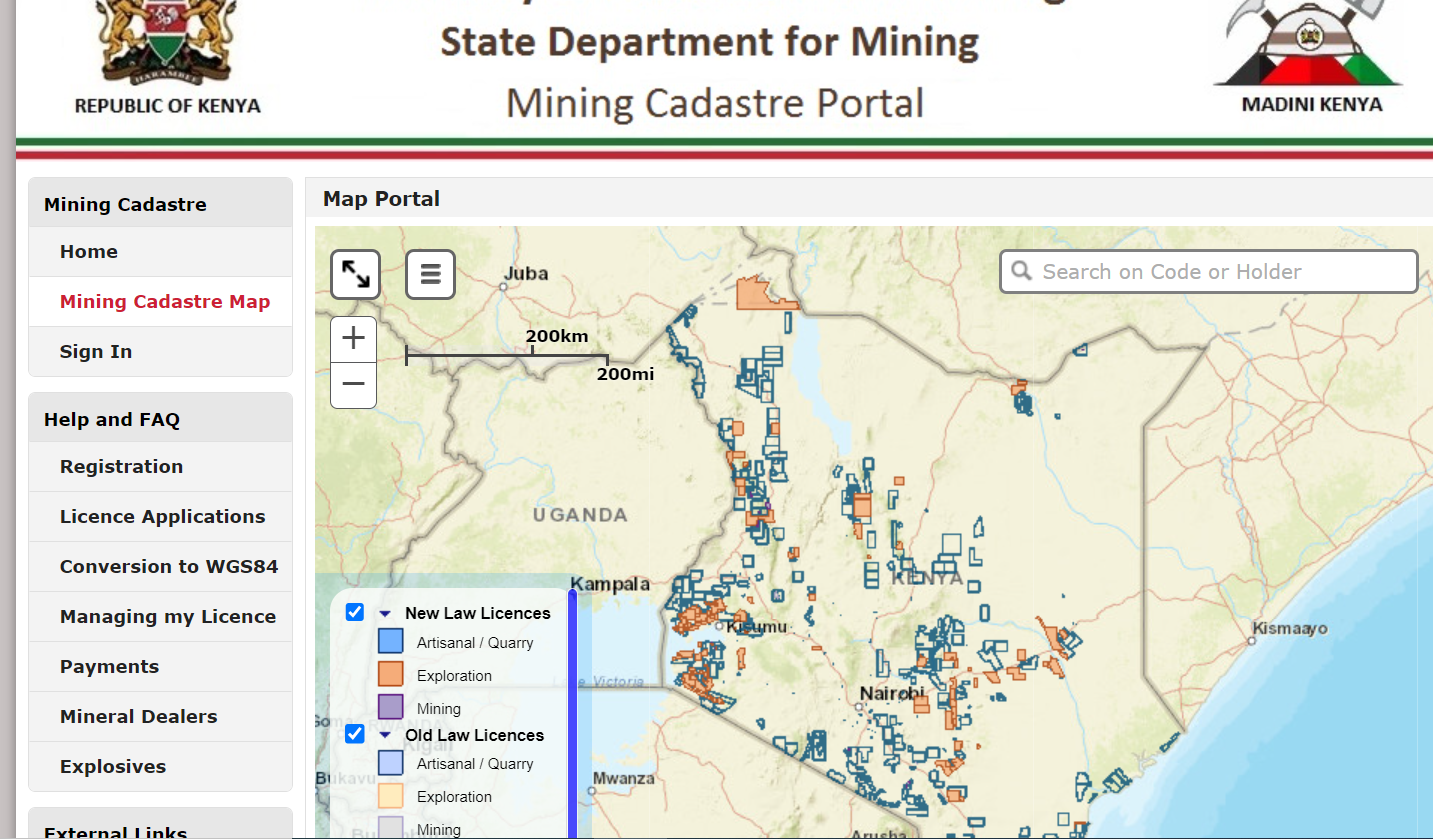

The country has an absolute advantage over many other countries. It is one of the world wealthiest economies that have developed as a mineral hub. With high mining economy that has dictated the main trading partners. Australia exports over 33% of its exports to China which is higher than the other top countries making the other top five combined.

Apart from mining, other sectors that are important to the country include manufacturing, tourism, education, farming and energy.

Australian Trade Policies

The country’s trade policies are towards a fair global trading environment and improved market access. The trade policies open doors for Australian businesses to stimulate competitiveness. There exist several multilateral negotiations among them the World Trade Organization (WTO) and the predecessor to the General Agreement Tariff and Trade (GATT). Others agreements include the Cairns Group (Reinhardt, 2015). The country has a trade-exposed and open economy. The meaning is that an increase in demand does not necessarily imply the same in supply.

The country’s trade policy gives priority to the right of entry to markets in a fairer global trading environment through the World Trade Organization (WTO) which is the forum for global liberalization. New Trade Theory applies to Australia’s context.

Regional Initiatives

Regional trade agreements in place since the accession of the country to WTO in 2002 include Hong Kong, New Zealand, Republic of Korea, Macao, Australia, Chile, South Africa, and India. The contents of these agreements differ from state to state. As of 2019, China had agreements with South Asian Nations (ASEAN). The country has eleven free trade agreements.

Bilateral & multilateral Agreements

These are also referred to as the side deal between countries. These may range from non-binding agreements to legally binding ones. These bilateral agreements aim to check trade deficits, lower trade barriers, increase variety and access to quality services at more attractive prices. The agreements promote access to markets for both countries. Some of these agreements include Hong Kong, Closer Economic Partnership Arrangement (CEPA).

Trade Promotion and Publicity AUSTRADE

The Australian government, through the Australian Trade and Investment Commission, assists businesses in trade and investment by providing Export incentives and Import Protection. The AUSTRADE also promotes the country’s national brand hence the perception of quality in the market.

The authority aims at promoting the Infant industry towards self-sufficiency. It also provides much-needed employment for the Australians.

Trade balance

The balance of trade as of December 2019 was $5,223 million.

Free trade Agreements

The country has over 14 Free trade agreements in place as of March 2020 (Department of Foreign Affairs and Trade, 2020).

Theories of Trade

The Australian model is known as the Salter–Swan–Corden–Dornbusch model (Metaxas, 2016). The model is also known as the dependent economic model. The country’s dependency on minerals fuels and other exports makes it very dependent and may lead to the Dutch disease.

2.2.1 Two-Way Trade

The main trading partners are Asian partners. The top five trading partners as of 2019 are China, Japan, United States, Korea and Singapore with the most exports being minerals and fuels followed by services.

The growth of Australia services sector is due to the industry’s action plan.

Two-way investment accounted for 6.05 trillion dollars at the end of the year 2018, with $3.5 trillion invested by foreign entities, while Australia entities invested $2.5 trillion overse

Inbound investment

It is investment coming from other places to a country. Non-Australians can buy a property and even invest in the country without restrictions. The investors will, however, apply for approval from FIRB to be allowed to purchase real estate. The country has an inbound investment bill to guide direct investment. This promotes Foreign Direct Investments (FDIs), which is among the most stable types of investment.

Government policy on protection

Small businesses are protected by the Australian government. There exists a consumer law. The federal government, state and local governments have legislation to protect small and medium businesses.

Tariff debate

The country has commitments on tariffs from WTO which gives tariff quotas, domestic support and export subsidies on agricultural products. Tariffs are paid on import of goods to Australia as taxes.

Regional and International Trade and Investment organizations.

Australia engages WTO, G20, OECD and APEC opportunities. The country participates in regional trade blocks by promoting regional trade opportunities. WTO determines trade rules for goods, intellectual property and services. Australia has been a member since 1995. Among the agreements include information technology agreements, trade monitoring and reviews, intellectual property, environment goods agreements and aid for trade.

The country is also a member of G20 \ a premier international forum which accounts for 85% of the world economy and has interests in co-operation and global economic governance. OECD is responsible for independent analysis and shares goals on trade, investment, competitiveness, innovation and productivity.

Australia is a founding member of the Asia-Pacific Economic Cooperation (APEC) whose aim was to boost regional economic growth. The members account for half of the global wealth. The country has supported the development of regional economic growth. The goal is to have free and open trade investment by 2020.

Tariffs schedule

Every country, including Australia, has a cascading tariff schedule to protect the local investment. Tariffs raise prices for imported goods hence giving local goods a competitive edge. Australia has tariffs commitments guaranteed under the World Trade Organization (WTO) on tariff quotas and tariffs. All goods imported in Australia have to be classified. They also erode competitiveness.

Industry Assistance

The government provides support to several industries. Over $19 billion was advanced between 2016 and 2017. Tariffs on imported goods are one way of protecting the local industry. Tax concessions, subsidies, and budgetary outlays are also used. The country shelters their own domestic companies from international competition.

In some cases, the government has invested in private companies through concessional loans.

Industry assistance and protectionism of other countries, among them the USA, will affect Australia’s export. There exist an infrastructure loan facility and farm business loan scheme. Manufacturing receives a big chunk of industry assistance but varied across different industries.

Limitation of Trade theory

The theory does not consider the difficulty involved in moving resources, demand fluctuation, trade barriers and political constraints.

Foreign Investment in Australia.

Foreign investment in Australia as at 31st December 2019 stood at $3,844.5b, being an increase of $278.9b (8%) the previous year. However, China was not among the top investors in the country with the leading in the top 5 positions being United States, United Kingdom, Belgium, Japan and Hong Kong (Australia Beaurea of Statistics, 2019). The country has held the top place in the global economic scale since World War 2 (Australian Bureau of Statistics). On the other hand, Australia investments abroad reached $2,953.1b, an increase of $405.4b (16%) from the previous years. China was number 6 investment country after the United States, United Kingdom, Japan, New Zealand and Germany.

In 2017-2018 Australia marked 27 years of steady economic growth without a recession. 2018 saw 1000 jobs created every day in the Australian economy. The country has an unemployment rate of 5.5 per cent.

Trade Agreements

In 2019, $438.1 billion in foreign investment was at record levels. Australia’s first trade agreement was with New Zealand in 1983. The country has gone further to make trade agreements, with the most recent being Australia-UK free trade agreement. Others are with Singapore, United States, Malaysia, Thailand, Chile, ASEAN, Japan, Transpacific partnership, comprehensive and progressive agreement, Hong Kong and Peru.

Foreign Direct Investments

Foreign Direct Investment (FDI) in Australia is driven by several theoretical models. It is encouraged by a friendly economic environment. Exchange rate discourages it over shorter-term but is quite beneficial on the longer term. There is, however, no evidence that tax incentives encouraged FDI (Faeth, 2005).

China is considered the second largest FDI recipient in 2019 after the USA and just before Singapore. The FDI law was adopted by the National People’s Congress on March 15, 2019. The USA is the biggest investor in China. In 2019 the FDI was 1.769 billion. The investors have to submit a proposal and facilitation done by the China International Promotion Agency.

Commodities Trade

photo of manganese minerals

Australia is the largest exporter of coal, unwrought lead, iron ore, wool (UN, COMTRADE 2019)

2nd largest exporter of aluminium ores, beef, lentils, and cotton. (UN, COMTRADE 2017)

3rd largest exporter of international education. (UNESCO 2016)

4th largest exporter of liquefied gas. (UN, COMTRADE, 2017)

World 5th exporter of wine. (UN, COMTRADE, 2016)

Education

Australian Universities host about 875,000 international students. 1 in 28 of these students is from China, which is equivalent to 262,500 Chinese students. 1 out of 5000 Chinese people studies in Australia. Chinese make up about 10% of the student body. Ten billion a year in economic contribution.

Tourism and manufacturing.

Tourism employs one I thirteen Australians. Among the most popular destinations include the harbour bridge, 28 years without a recession economic growth better than any other country.

About China

China has a large population and hence a large pool of resources. Besides, the country has the equipment, technology and cheaper energy through coal-powered plants and other things. In 2019, China shipped US$2.499 trillion worth of goods, being 9.9% gains since 2015 and 0.02% increase (China’s Top 10 Exports, 2020) from 2018.

The top exports include electrical machinery, equipment, computers and furniture, plastics, vehicles, optical, technical and medical operators. The recent development has toys export grow with about 10.7% (China’s Top 10 Exports, 2020).

Until recently, the production materials deposit accounted for over 80% of imports to China.

China’s economy is guided by the 14th, five-year plan. With the world trying to eliminate coronavirus, the country has the dual circulation policy in place to focus more on bolstering local economy (How China is preparing its economy for a future where the U.S. isn’t the center of global demand, 2020). The country is likely to be a global lead economy soon.

Free trade Agreements

This Transpacific Agreement is a multilateral trade agreement whose objective was to liberate economies found in the Asia-Pacific region. China is a big brother whose policies benefits smaller nations in the region. The agreements are signed by China, Singapore, Brunei, New Zealand, Malaysia, Australia, Peru and the United States. The interest of the USA was seen as one meant to counter China’s influence.

China’s Trade Protectionism

The country gives strong incentives to its domestic companies to ensure competitiveness. These may include hidden subsidies and tax cuts.

China’s trade Theory

China uses Heckscher-Ohlin trade theory (H-O Theory) in its foreign trade on relative capital intensity. The principle of comparative advantage is such that if a country specializes in a good or service, produces it more efficiently and trades it for the goods it does not have, there will be a benefit.

Trade between China and Australia

Several factors enable Trade between China and Australia. Australia has a massive amount of land that is under-utilized for settlement hence useful for mining and agriculture. China has cheap labour, skilled population available to work and necessary technological advancement. China buys a third of everything Australia sells in addition to the high number of tourists and students. Chinese students in Australia account for 17% of total revenue based on statistics from nine leading universities. Tourists spend AU$11 billion per annum.

Australia-China trade relationship has lasted for over three decades with China being Australia’s major trading partner both in exports and Imports. Australia is heavily dependent on China as the major trading partner with the exports to china being a substantial amount of business. The total value of trade flows between Australia and China in 2018 was $91.1bn (Resource Trade Earth, 2020) with metals and minerals accounting for 43 per cent of exports from Australia and 11% of imports to China. In 2018, 31% of all its exports went to China (Chan, 2020). The Australian trade surplus with China was A$58.26 billion, which was about 250% of the total trade surplus A$23.23 billion (Chan, 2020). Raw minerals are used for Chinese industries while there is a sizeable investment coming from Chinese companies to Australia.

China exports to Australia stood at US$56.95 Billion during 2019. The exports included electric equipment, machinery, nuclear reactors, boilers, furniture, mineral fuels, articles of iron and steel, vehicles, toys and seafood.

Although China has been Australia’s main trading partner, China has recently imposed an 80% import tax on Australian barley in addition to suspending beef export from Australian Abattoirs. This has been due to Canberra’s call to investigate the COVID-19 pandemic hence exposing how vulnerable Australia is when having China as its main trading partner.

Chinese investors have been buying quite huge investments in Australia ranging from agricultural land, real estate, Iconic buildings, utilities and important infrastructure.

The China-Australia Free Trade Agreement (ChAFTA)

The agreement came into force on 20th December 2015. The agreement was to reduce tariffs, access to markets by giving preferential tariff rates to Australian goods and zero-rating tariffs for more than 85% of goods at the beginning, with a target of 98% upon full implementation of ChAFTA. The agreement puts Australian goods at a competitive advantage while at the same and makes them accessible at competitive prices for the Chinese market (China Australia Free Trade Agreement, n.d.).

Mining

Australia is the world largest producer of minerals and sells over 60% to China. (Casey, 2022). China is heavily dependent on Australia for its iron and steel industry. Australia produces 29% of the world’s coal. China’s imports on coal have increased to 66.5% year-on-year. The quality of Australian coal is better than any of the competitors. China buys a particular type of high-quality coal ore with 55000 Kilocalories per Kg from $30 for a tonne. The coal is also cheaper due to the proximity between the two countries.

Agriculture and Farmlands

Agricultural products accounted for $8.1bn in 2019 (Resource Trade Earth, 2020). They included fodder crops, wool, meat, cereals, fish and aquatic resources, dairy, eggs, honey and other animal products.

Chinese investors have bought vineyards and wineries from Australian citizens. China’s winemakers now have vineyards in Australia exporting the wine direct to the market in China.

Barley and beef are other products exported from Australia to China.

Industrial products

Both Australia and China export industrial products to each other. While most equipment and machinery come from China, products like the Australian Baby formula for the 17 million babies born annually is famous in China for Chinese believe to be of high quality. The locally-made product tested positive for impuriti

Investment in Critical Infrastructure.

In 2016 investment in Australian infrastructure by China was $4.3 billion, which is 28.3% of Chinese investment in Australia. Critical infrastructure utilities, like Port of Darwin, is now owned by a Chinese company through a 99-year lease. The Chinese owned Landbridge group from the Northern Territory government sealed the A$506 million deals.

Chinese nationals have invested in critical national infrastructure in Australia. They were in the process of purchasing the National electric grid has been stopped for security reasons, with activists arguing that it would be giving away so much power to foreigners (DARWIN, 2019).

Real Estate

The real estate market in Australia has skyrocketed. As a consequence, it very difficult for Australians to own a home in their own country. Home prices have gone up in major cities like Sydney. New South Wales imposed an additional charge of 8% for foreign buyers. The driving force is that the Chinese booming middle class who now earn a decent income move ahead to invest in such countries. Australia has no restrictions on foreigners buying land like most countries around the world. Also, it is quite expensive to own property in China and cheaper to get single units in Australia.

The Chinese investors have also bought landmark buildings, including the building that hosts Australian stock exchange, now owned by a renowned investor who owns a toys manufacturing company.

China represents 87% of foreign real estate buyers with New Zealand coming in second with less than 1.7 per cent.

Manufactured goods from China to Australia

Australia’s imports in 2018 were over AUD 21 billion and mostly included IT products, Telecommunication equipment, homewares and furniture. Others include machinery, nuclear reactors, and boilers, steel products, mineral fuels and distillation boilers. In addition to that, prefabricated buildings, toys and plastics are also imported.3.8

China, Australia Trade Wars

Given the interdependency of the two countries, any disagreements would lead to massive losses on either side. In 2020, during the pandemic, China slammed a ban on barley from Australia with a tariff of over 80%, preventing Australian farmers from exporting to China. They claimed that pests were found in multiple shipments even without any substantial evidence.

In October 2020 China slashed coal imports quota. The moves were taken after the prime minister of Australia, Mr. Scott Morrison, led in the push for an international investigation into the origin of coronavirus. Most of the Chinese coal clients have informed the suppliers of the development, including coal that is on board the ship and that it is already being offloaded.

Australian wine is very popular with the affluent Chinese as it is believed to be of good quality. China went ahead to impose anti-dumping measures on Australia’s wine. The investigations are to run for eighteen (18) months from September 2020 (Australia, China trade war ensures mutual destruction, 2020). This not only hurts Australian businesses but also Chinese businesses supplying the wine.

Besides, China foreign investments review board advised a Chinese Diary company against procuring a local company that is well known for milk and popular soft drinks. Purchasing from five abattoirs have been stopped based on allegations of the presence of a chemical chloramphenicol while the other four were because of anti-dumping dispute (Australia, China trade war ensures mutual destruction, 2020).

On the other hand, Australia has threatened to cancel all the trade agreements that do not serve their own domestic interests. The first of this has been Beijing’s Belt and Road Initiative (BRI). Australia’s strength is in commodities that China relies on and cannot get from elsewhere conveniently.

There are fears from the cotton buyers in china with speculation that cotton tariffs may increase to as high as 40%. The Chinese government determine how much any of the mills buy and from where through Quotas.

Australian businesses have taken a hit with impacts ranging from a drop in share prices, loss of business.

3.8.1 Debt Trapped diplomacy

China is lending billions to nations that cannot afford to pay back. Later they convert the debt to equity and acquire strategic influence and assets. The communist party around the world in places like Africa or Sri-Lanka have given loans. As a consequence of failure to pay, debt converts to equity leading to loss of strategic government assets. China has invested heavily on Australia’s infrastructure. This, in return, has contributed to a rise in its influence in the region.

Dependency on China for essential Goods, especially during the pandemic, and precarious nature of the supply chain as shown by the 25.6 per cent of trade in one basket, points to one thing: it’s time to reconsider the supply chain especially for vital commodities. These include medical and pharmaceutical goods that could be made in Australia to reduce its vulnerability.

3.8.2 Australian Dependency on China trade

Australian dependency on China is bigger than any other nation, which is also a risk in case of the bad relationship between the two countries. China accounts for 32.6% of exports. China ranks as the Globalization and Free Trade

Free trade between the two countries ensures that the two countries have trade quotas and are exempted from particular tariffs hence ensuring affordability of goods from one country to the other. Globalization has increased the free flow of goods and services between countries.

Trade and Politics

China and Australia have different kinds of governments with China having a Communist regime while Australia is a multicultural and open democracy (Countering China’s Influence Operations: Lessons from Australia, 2020). China’s influence on the political landscape has been evidence. Misinformation campaigns have been reported.

Australia Supported Hong Kong when China wanted to impose the National security laws leading to a clash between the two countries.

Australia’s COVID-19 rules affected the supply chain. All these factors have led to China looking for new suppliers for raw materials leading to an uncertain future.

Conclusion

` Australia and China have enjoyed mutual trade for a long time. The relationship is convenient because of geographical location, presence of goods, labour and technology.

Recent events characterized by China and Australia wars is a clear indicator of the risks associated with over-dependency of one trade partner. Whether the trade wars are of genuine technical nature or the need for China to protect its local market like in the case of barley is yet to be established. Australia should reduce its dependency on China and look for alternative markets. The country should build a domestic industry to absorb some of its raw materials to guard the country against the risks associated with trade dependency, unnecessary economic pressure and political interference, threats and economic coercion. Both China and Australia are members of various trading blocks and international agreements. Australia has threatened China on WTF challenge on barley. The world is watching to see how the strong relationship between China and Australia will survive the storm.

References

Australia Beaurea of Statistics. (2019, December 31). International Investment Position, Australia: Supplementary Statistics. Retrieved from Australian Burea of Statistics: https://www.abs.gov.au/statistics/economy/international-trade/international-investment-position-australia-supplementary-statistics/2019

Australia, China trade war ensures mutual destruction. (2020, September 12). Retrieved from Asia Times: https://asiatimes.com/2020/09/australia-china-trade-war-ensures-mutual-destruction/

Casey, J. (2022, September 16). All change: threats to China’s stake in Australian mining. Retrieved from Mining Technology: https://www.mining-technology.com/features/all-change-threats-to-chinas-stake-in-australian-mining/

Chan, L.-H. (2020, May 22). Can Australia Flatten the Curve of Its Economic Dependence on China? Retrieved from The Diplomat: https://thediplomat.com/2020/05/can-australia-flatten-the-curve-of-its-economic-dependence-on-china/#:~:text=In%202018%2C%20Australia’s%20trade%20surplus,%2C%20the%20U.K.%20and%20ASEAN).

China Australia Free Trade Agreement. (n.d.). Retrieved from Australian Government Department of Foregin Affairs and Trade: https://www.dfat.gov.au/trade/agreements/in-force/chafta/doing-business-with-china/Pages/guide-to-using-chafta-to-export-or-import#:~:text=https://www.dfat.gov.au/sites/default/files/guide-to-using-chafta-to-export-and-import-goods.pdf

China’s Top 10 Exports. (2020, September 27). Retrieved from Worlds Top Exports: http://www.worldstopexports.com/chinas-top-10-exports/

Countering China’s Influence Operations: Lessons from Australia. (2020, May 8). Retrieved from Centre for Strategic and International Studies: https://www.csis.org/analysis/countering-chinas-influence-operations-lessons-australia

Countering China’s Influence Operations: Lessons from Australia. (2020, May 8). Retrieved from Centre for Strategic and International Studies: https://www.csis.org/analysis/countering-chinas-influence-operations-lessons-australia

DARWIN, C. (2019, March 13). How and why did the Northern Territory lease the Darwin Port to China, and at what risk? Retrieved from ABC: https://www.abc.net.au/news/2019-03-12/why-did-northern-territory-sell-darwin-port-to-china-what-risk/10755720

Department of Foreign Affairs and Trade. (2020). Trade and Investments at glance 2020. Barton: Department of foreign affairs and trade.

Faeth, I. (2005, September ). DETERMINANTS OF FDI IN AUSTRALIA:. Melbone: University of Melbone.

How China is preparing its economy for a future where the U.S. isn’t the center of global demand. (2020, August 31). Retrieved from CNBC: https://www.cnbc.com/2020/09/01/dual-circulation-how-china-is-preparing-for-a-new-role-in-international-trade.html

IMF. (2020, Feb 21). Board Discussions on Australia. Retrieved from International Monetary Fund: https://www.imf.org/en/Countries/AUS

Krist, B. W. (2013). Globalisations and America’s Trade Agreements. Woodrow Wilson Center Press / Johns Hopkins University Press. Retrieved from https://www.wilsoncenter.org/chapter-3-trade-agreements-and-economic-theory

Metaxas, P. &. (2016). An Australian Contribution to International Trade Theory. The dependent Economy Model. Economic Record 92, 92.

National State and Territory Population. (2020, March 31). Retrieved from Australian Beaural of Statistics: https://www.abs.gov.au/statistics/people/population/national-state-and-territory-population/latest-release

Reinhardt, E. D. (2015). Multilateral Determinants of Regionalism: The Effects of GATT/WTO on the Formation of Preferential Trading Arrangements. World Scientific Studies in International Economics, 295-328. Retrieved from World Scientific Studies in International Economics: Multilateral Negotiations within the GATT

Resource Trade Earth. (2020, October 16). Retrieved from Chatham House: https://resourcetrade.earth/data?year=2018&exporter=36&importer=156&units=value